georgia property tax exemption nonprofit

ZEV Sales Tax Exemption. These specialized exemptions are usually a reduction of up.

Georgia Charitable Registration Harbor Compliance

Before sharing sensitive information make sure youre on a federal government site.

. Enter the sales tax numbers for verification. Organizations which intend to pursue tax exemption with the IRS must include specific. Of the states with data available for personal property personal property made up 1127 percent of the average state property tax base in 2006.

Exemptions and Exclusions guide to see if your organization is eligible to apply for an exemption. Visit the Georgia Tax Center. Deduction andor exemption tied to federal tax system.

The mailing address for Form 3605 is Georgia Department of Revenue 1800 Century Center Blvd. Use SmartAssets property tax calculator by entering your location and assessed home value to find out your property tax rate and total tax payment. To check whether an organization is currently recognized by the IRS as tax-exempt call Customer Account Services at 877 829-5500 toll-free number.

Print a copy of the search results for your records. On March 18 Gov. Sales Use Tax Import Return.

NE Suite 15311 Atlanta GA 30345-3205. No longer required for tax years beginning on or after 112008 Forms 990 and 5500 should be mailed to Georgia Department of Revenue PO. Alternatively an Excel template is available to complete and import.

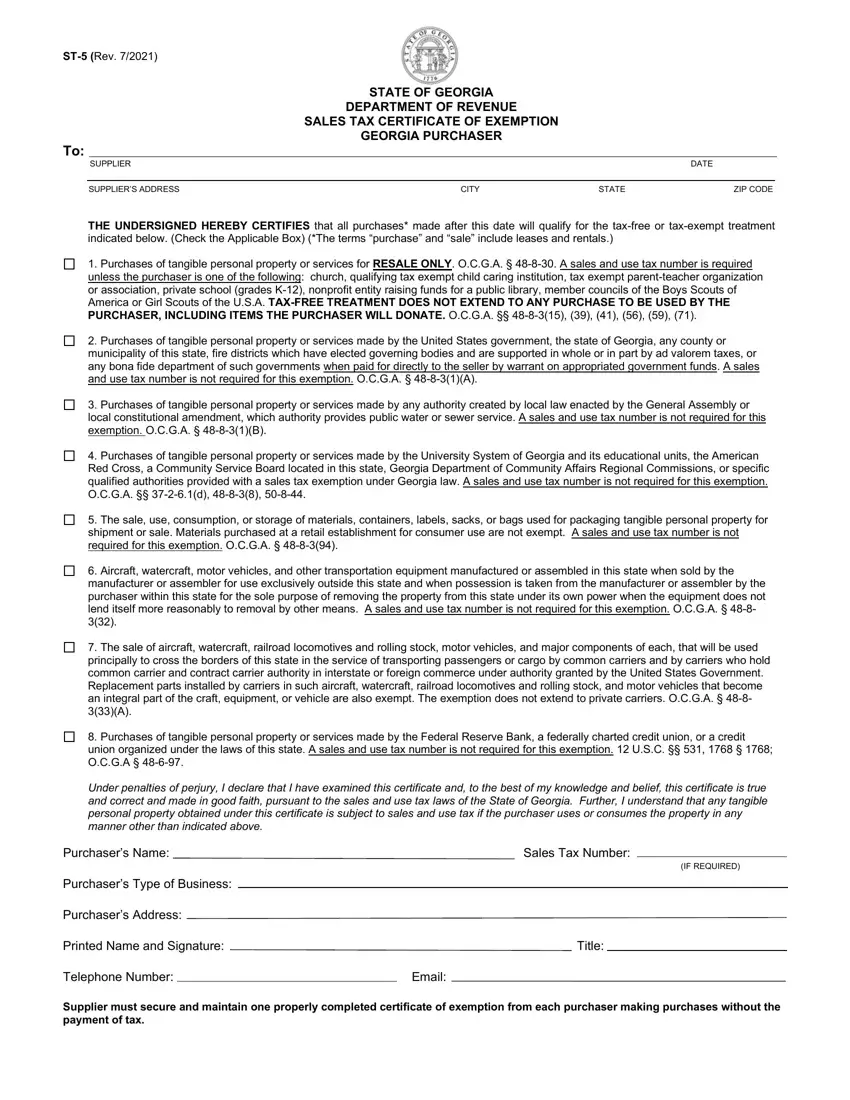

When an exemption certificate is needed. In general Georgia statute grants no sales or use tax exemption to churches religious charitable civic and other nonprofit organizations. The New Jersey Department of Environmental Protection provides grants through the It Pay to Plug In program.

This tool only. In other words nonprofit organization must be organized and operated exclusively for one or more exempt purposes. Federal government websites often end in gov or mil.

For example state and local officials may grant exemption from income sales or property taxes. 705 Sales of tangible personal property ie not services to a nonprofit health center in Georgia which has been established under the authority of and is. Senate race border wall gets a makeover.

Sales Use Tax - Purchases and Sales. The gov means its official. Materials installed to service a particular property.

The state enacted HB 5501 on March 24 which suspended the states 25-cent motor vehicle fuels tax from April 1 until July 1. This includes most tangible personal property and some services. A The term sales price applies to the measure subject to sales tax and means the total amount of consideration including cash credit property and services for which personal property or services are sold leased or rented valued in money whether received in money or otherwise without any deduction for the following.

On the Home page under Searches click on Sales Tax IDs. Florida Department of Revenue. Filing and Remittance Requirements This is a link to Rule 560-12-1-22 on the Georgia Secretary of States website Sales Tax ID Verification Tool.

ZEVs sold rented or leased in New Jersey are exempt from the state sales and use tax. The Tax Foundation is the nations leading independent tax policy nonprofit. Volunteer fire departments veterans organizations qualifying youth organizations religious organizations and few others may be eligible for exemption.

This fell to 1015 percent of the average state property tax base in 2012 and to 998 percent of the average state property tax base in 2017 See Table 1. The latest Lifestyle Daily Life news tips opinion and advice from The Sydney Morning Herald covering life and relationships beauty fashion health wellbeing. Follow the instructions of the Secretary of States Corporations Division to register as either a domestic corporation or foreign corporation.

Must contain at least 4 different symbols. Since 1937 our principled research insightful analysis and engaged experts have informed smarter tax policy at the federal state and global levels. A sales tax exemption certificate is needed in order to make tax-free purchases of items and services that are taxable.

State Gas Tax Holidays Connecticut. HB 7071 included a provision to suspend the states 253 cents per gallon fuel tax for the month of October. Florida Department of Revenue Executive Director Jim Zingale issued Order of Emergency WaiverDeviation 22-003 Sales and Use Tax and Related Taxes extending certain filing due dates for Florida businesses located in specific counties impacted by Hurricane IanThe order extends the September 2022 and October 2022 reporting periods for sales and use tax.

Exemption from federal income tax under IRC Section 501c3 see. In addition the US. TSB-M-071S Electronic Resale and Exemption Documents for Sales and Compensating Use Taxes.

Box 740395 Atlanta GA 30374-0395. These organizations are required to pay the tax on all purchases of tangible personal property. The big and beautiful US-Mexico border wall that became a key campaign issue for Donald Trump is getting a makeover thanks to the Biden administration but a critic of the current president says dirty politics is behind the decision.

Certain exemptions were provided for taxation of possessory interests in government property as unsecured personal property. Calculating Tax on Motor Fuel. Federal deductions and exemptions are indexed for.

Sales Tax Instructional Documents. Brian Kemp R signed HB 304 immediately suspending. ASCII characters only characters found on a standard US keyboard.

Tips for Completing the Sales and Use Tax Return on GTC. None Use tax exemption for contractors 3 Federal retailers excise tax if itemized to the consumer separately from the. See the Sales and Use Taxes.

Get the latest science news and technology news read tech reviews and more at ABC News. 6 to 30 characters long. However a not-for-profit corporation that is exempt from federal taxation under Internal Revenue Code section 501c3 is only required to file a Florida corporate income tax return Form F-1120 if it has unrelated business income or it files federal Forms 990-C or.

Politics-Govt Just in time for US. Most states and counties include certain property tax exemptions beyond the full exemptions granted to religious or nonprofit groups. Few nonprofits are eligible for sales tax exemption in California.

Read the instructions and tips carefully. Postal Service offers reduced postal. The organization may have applied to the IRS for recognition of exemption and been recognized by the IRS as tax-exempt after its effective date of automatic revocation.

A property tax exemption was established for property owned by a nonprofit organization that was used by the state or political subdivision exclusively for governmental activity. Stay informed and read the latest news today from The Associated Press the definitive source for independent journalism from every corner of the globe. Whether or not your organization is formed under the laws of the State of Georgia it must be registered to conduct business in the State.

The sales tax exemption does not apply to hybrid electric vehicles. Not-for-profit corporations are subject to corporate income tax.

Why Some Argue Tax Exempt Institutions Should Be Paying Property Taxes

2007 Sutherland Asbill Brennan Llp Introduction To Georgia Property Tax For Non Profits Charlie Kearns Sutherland Asbill Ppt Download

Georgia Form St 5 Fill Out Printable Pdf Forms Online

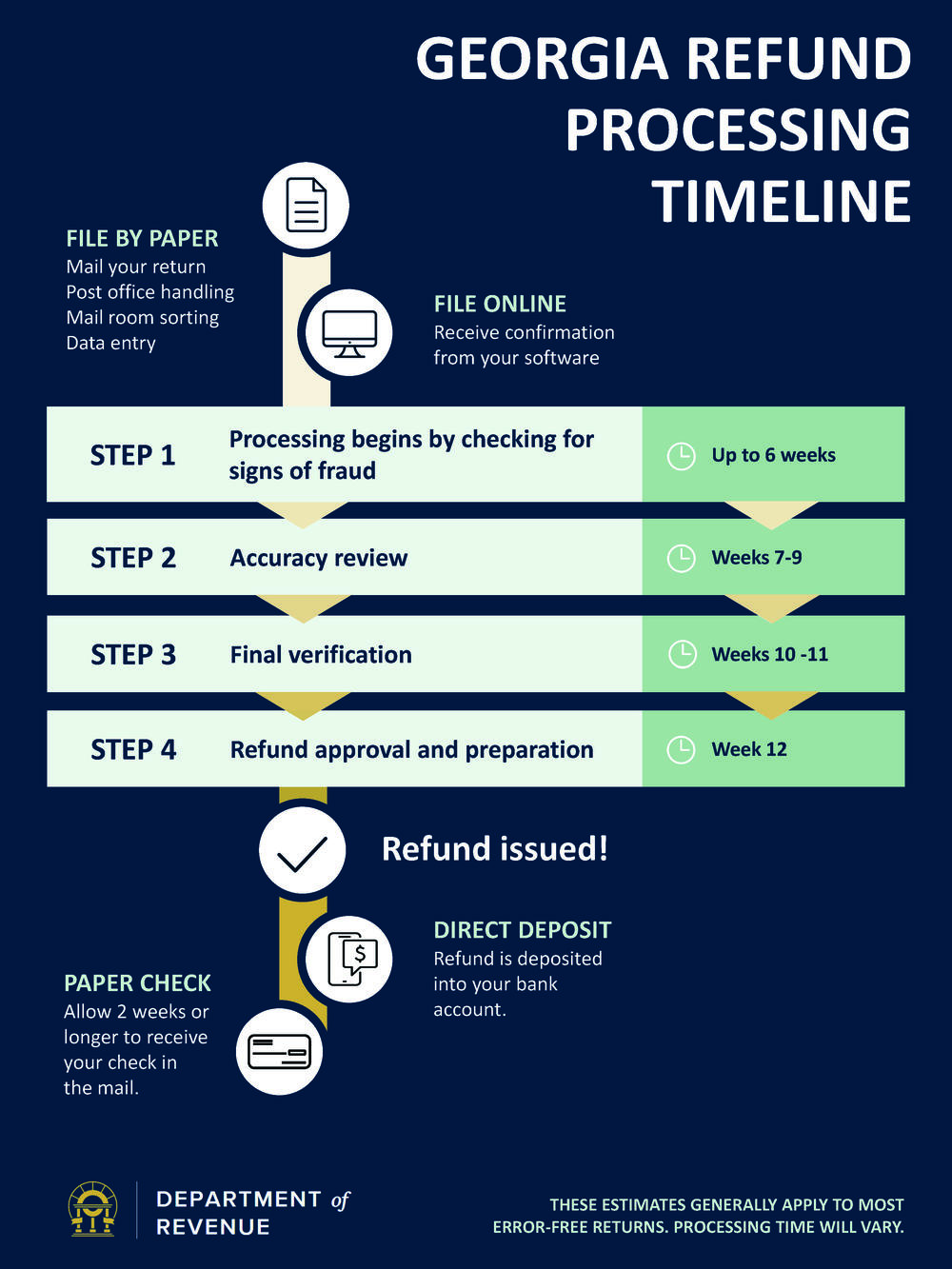

Where S My Refund Georgia Department Of Revenue

10 Ways To Be Tax Exempt Howstuffworks

Turner County Tax Assessor S Office

How To Register A Foreign Non Profit Corporation In Ohio

Understanding Your Property Tax Bill Department Of Taxes

Introduction To Georgia Property Tax For Nonprofits Youtube

These Are The Ballot Measures You Can Vote On In The Georgia Midterm Election Wabe

Exemption Summary Richmond County Tax Commissioners Ga

What Is Homestead Exemption How To Reduce Property Taxes Georgia Taxes 2021 Property Taxes Youtube

Georgia Exemption Fill Out And Sign Printable Pdf Template Signnow

State Property Taxes Reliance On Property Taxes By State

How To Register A Foreign Non Profit In Georgia

Tangible Personal Property State Tangible Personal Property Taxes